Waikato financial services' stalwart aims to double loan book over next five years

One of the country’s largest home loan providers celebrates its twentieth birthday by “gifting” itself the goal of doubling its portfolio size in five years.

Established in Hamilton on 26 November 1996 by founders John Erkkila and Murray Ferguson, New Zealand Home Loans (NZHL) lends $5.2 billion in home loans to more than 19,000 New Zealand families, currently saving them more than $33 million in home loan repayments.

Part of Kiwi Group Holdings and a sister company to Kiwibank, NZHL has grown from a single franchise in Wellington to a 220-strong team operating through 78 offices across New Zealand, spread from Dunedin to Whangarei.

NZHL has picked up numerous accolades along the way, including Supreme Award at the Waikato Business Excellence awards in 2013 and the Deloitte Fast 50 award for Fastest Growing Mature Business (Central North Island) in 2012 and 2013.

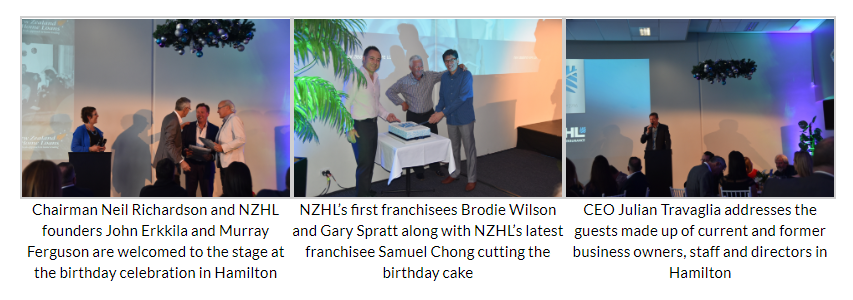

To celebrate the company’s twentieth anniversary, NZHL held a dinner for over 130 of its current and former business owners, staff and Directors in Hamilton .

Long serving Chairman of NZHL, Neil Richardson, says it’s hard to think that it’s been 20 years since the company was established, at a time when Jim Bolger was Prime Minister and “How Bizarre” by OMC was the hit single.

“Our vision for NZHL was to help reduce the burden placed upon families and households by home loans and to help them manage their finances better. With over $33 million currently being saved by NZHL clients paying off their home loans quicker, the company is living up to that goal.”

CEO Julian Travaglia says while he’s been in the role for just over a year, and feels like a spring chicken in comparison to some of the NZHL family, he’s looking forward to playing a part in growing the potential of NZHL’s future.

“It’s not often a company in this space can say it’s been operating for two decades. I’m really proud of that and the fact NZHL currently lends $5.2 billion in home loans out to over 19,000 New Zealand families who are now experiencing what’s it like to feel on top of their mortgage and finances. Much of this has to do with our consultants providing them with the personal support along the way which is increasingly proving to be a key point of difference compared with many of the big banks that are favouring technology over people.”

“With house prices going the way they are, there’s a real opportunity to double our lending figure as it’ll be even more important in the future for Kiwi households to have home loans paid off quicker, for the benefit of individual families but also in the interest of levels of indebtedness we face as a nation.”