What is Refinancing?

Refinancing simply means replacing or paying off your old home loan with a shiny new one. That's all.

The new home loan can have a shorter term and a lower interest rate.

When should you consider Refinancing?

The end goal of refinancing is to decrease your monetary burden and all the stress related with it, so you can move one step closer to controlling your debts.

Here's when refinancing will be ideal:

- Length of your new home loan is shorter

If you still have a significant number of years left to pay off your current home loan and you're eager to become debt-free sooner.

- Terms of your new loan are more advantageous

Read the terms and conditions of your potential new home loan carefully before you sign anything. For example, check if there are any prepayment penalties or the amount of time you have before foreclosure is enforced. If the new home loan offers more favourable terms and conditions than your current one - you should go for it.

- The new interest rates are lower

Are you qualifying for a lower interest rate than your current one? If yes, then you should consider taking the deal.

Advantages of Refinancing

1. Get a fixed interest rate

Adjustable-rate mortgages typically offer a lower interest rate for the first few years as compared to fixed-rate mortgages.

But what sort of 'adjustments' occur with these adjustable rates? Well, as you can probably imagine, the interest rates get higher with time and increase your overall payments.

(Read more: What lenders are looking for)

Adjustable-rate mortgages might not be a big hassle if you're only considering owning the house for a short period of time, but if your plan is more permanent or long term - a fixed-rate home loan maybe a better option, depending on your other life goals.

If you're stuck with adjustable interest rates, consider refinancing to a fixed rate home loan.

2. Become debt-free faster

It's become the norm that home-owners accept. You pay your mortgage for 30 years and may pay more than what you actually bought your house for.

Just because that is the norm you don't HAVE to accept it.

Short term loan interest rates, while keeping your loan over a 30 year term, is unlikely to assist you in your overall financial position or helping you achieve your other goals.

You might have lesser monthly payments for a 30-year loan, but you'll have to pay the interest on the principal amount throughout these years.

However, if you refinance and switch to a shorter term, let's say for 15 years, you may save a significant amount of money on interest.

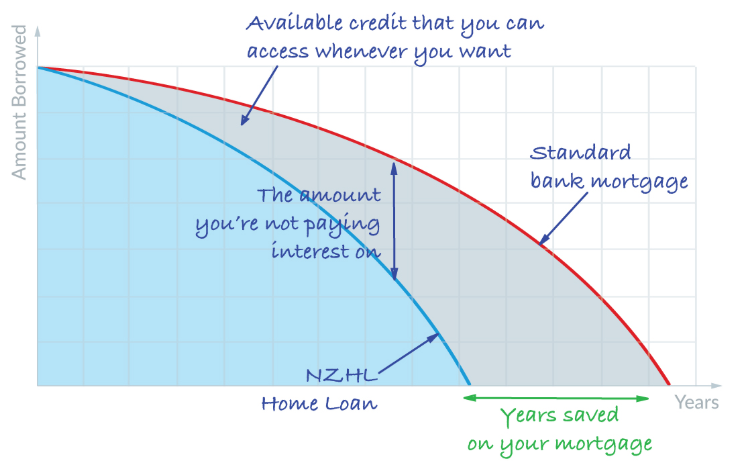

You could get the best rate from the bank every time you fix your rates for the next 30 years... But what if you get the great rate with the great structure?

You can get debt free faster saving thousands and years off your loan. And an easy way to achieve this is

with your own personalised structured loan.

3. Lower Interest Rate

A lower interest is what attracts a lot of people to refinancing.

Are you always short on cash? If you dig deeper and find the root cause of this, you'll realise that it may be those monthly installments that you pay on your home loans.

You can always refinance and choose a new home loan with a lower interest rate than your current one.

Even a minor decrease on your interest rate can save you thousands of dollars in the long run and refinancing is the one the best ways to achieve this.

Changing your home loan can be a daunting task, so it's important that you have a dedicated and experienced consultant who will be there to assist you at every step.

Here at NZHL, we're committed to making the process as easy as possible for you.

Don't just take our word for it, here's what our clients have to say about us.

Want to free yourself from the chains of a 30-year mortgage?

Book a no obligation appointment with one of our consultants to see how we may be able to help you save money on your home loan.