I know a guy, let’s call him Tim. I think he is about 25 and in the last year he bought his first ever house. He is pretty proud of it and rightly so and I’ve noticed that the responsibility has made him grow up pretty quickly. That is he can’t go out drinking with his mates until 5am because he needs to get up early to work on his house, mow his lawns and plant some vegetables (yep, he actually planted some veggies in his garden). And he was AMAZED to work out that it saves him money by NOT going out drinking RTD’s and smoking durrys! Who knew? Well well well, leopards can change their spots and I remarked that his parents must be pretty relieved to see their wild child son calm down a bit at last. I’m sure they must be sleeping better at night now.

He kind of knows that I know quite a bit of stuff about money, but he doesn’t want to come straight out and ask direct questions about it. And because he is young and a bloke I don’t want to even attempt to engage him in deep financial discussions (as much as I desperately want to). So we talk, just a little bit, about money and what he is doing with his.

Our chats are always brief, often weeks apart, always in passing and often ALARMING:

Tim: “I’m going to buy a new car on my mortgage Ruth”, he says as he passes me in the corridor…

Me: “Nooooooo don’t do it you FOOL” I shout at his retreating back.

Tim as he drives away: “I’ve decided that from 2019 I’m going to start paying down the “main bit” of my mortgage Ruth”...

Me: “Noooooo, are you trying to tell me you are paying an interest only mortgage???” I shout after him. Ye Gods!

Now he knows he can get a rise out of me and he goes out of his way to wind me up…

Tim: “I’m increasing the mortgage so I can renovate”... As he heads out the door for lunch.

Me, shouting like a fishwife: “You are broke man. Pay your freaking mortgage and stop adding to it for goodness sake”!\

But sometimes he will linger for a chat about something specific and tell me “I’ve paid off my credit card and THAT’S IT I’m not touching it again!”

At which point I congratulate him and hand him a pair of scissors.

Therefore, I know that little by little our discussions ARE helpful to him.

Just last week he announced that he received a “BONUS THOUSAND BUCKS”. He was pretty vague as to where it came from, some “accounting error” that worked in his favour or something but “WHO CARES, $1,000 is $1,000 bucks right?” Of course I pointed out that it’s not free money, it’s just his OWN MONEY coming back to him but nope, this felt like a lottery win to him.

So, what would YOU do with a financial windfall?

Whenever I ask people this question there are a heck of a lot of hypothetical holidays being booked, because they view it as free money that they never budgeted for, therefore they can just spend it all.

My husband and I have had two windfalls of significance that have made a real impact on our lives. Each came from businesses he was involved with. In the first instance he had a new partner buy into the company he owned with two others and then in the second he sold out of another company he helped create. The first time this happened we still had a mortgage and that cash went straight on it. All of it. Because our mortgage was “revolving credit” (or revolting credit as we sometimes referred to it) that money could immediately be put against it and it made a substantial impact on bringing the loan closer to zero, thus saving us oodles in interest payments and allowing us to pay it back so much faster. There was never any doubt that the money would be used to pay down debt and buy our freedom from the bank. When we got our second windfall we were mortgage free but coping with the Christchurch earthquakes, so that money added to the emergency fund that we already had and some of it was used sparingly for day to day living.

I don’t recall celebrating with champagne or anything when the money came through but I do recall getting enormous satisfaction out of seeing our debt shrink. My husband had put a lot of his life into each business so it was a reward for a lot of long days and late nights over the years. Seeing it come into our bank account never prompted a round of extravagant spending, instead we still went about planning and budgeting for things we had been planning to do in the future anyway, such as holidays etc. It didn’t prompt any new splurging and saving the bulk of it was always our first option.

It brings me back to an old gold miner I know who told me “Ruth, everyone gets a few lucky chances in life, big pivotal points that if you handle them well will set you up”. Financial windfalls, expected or otherwise, are just those lucky breaks he was talking about.

Unless it is Lotto you have won, which does come as an unexpected surprise, when you come into some money either via business or family or an “accounting error”, generally you know it is on its way. My advice on what to do with it would be this:

- Don’t actually spend a cent until you actually have it in your account. I’ve read enough gossip mags which talk about people who had their Great Grandma's’ dosh well and truly spent before they received it because she was on death's door and an inheritance was imminent, only to have her sitting at the head of the Christmas table again at Christmas. Go Grandma!

- When you do receive a chunk of cash, for whatever reason, put it in a high interest account (yeah I know they are hard to come by) while you work out your options.

- Pay down debt first. Mortgage or credit card debt: whatever your debt of choice is, get rid of it!

- Don’t fritter it away! These opportunities don’t come around often so give that money a purpose as quickly as you can.

So, what did my young friend do with his $1,000?

Me: “So Tim, I’m intrigued… what have you done with your $1,000”?

Tim: “I’m still waiting for it to hit my account but I’m pretty sure I’m going to spend it on my Falcon”. That’s a car, he is certainly NOT an ornithologist.

Me: “You are killing me here man!

I know when I’m beat, he probably will spend it on his car BUT I didn’t give up hope just yet and instead grilled him on his mortgage stats and 5 minutes later gave him a 30 second pitch with the following…

Me: “Tim, mate, I can’t stress enough how you should put any spare cash towards your mortgage because it will save you in the long run…

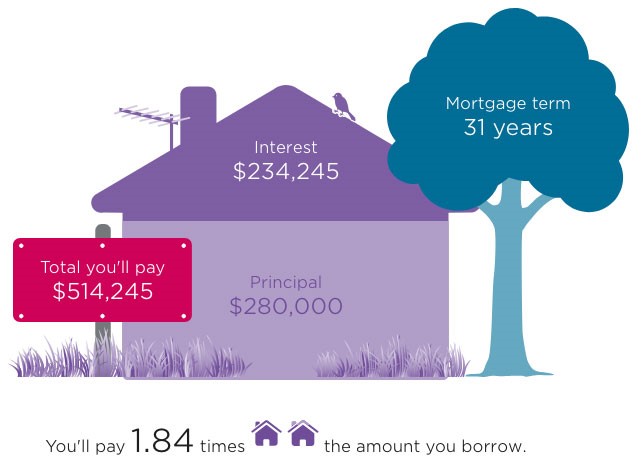

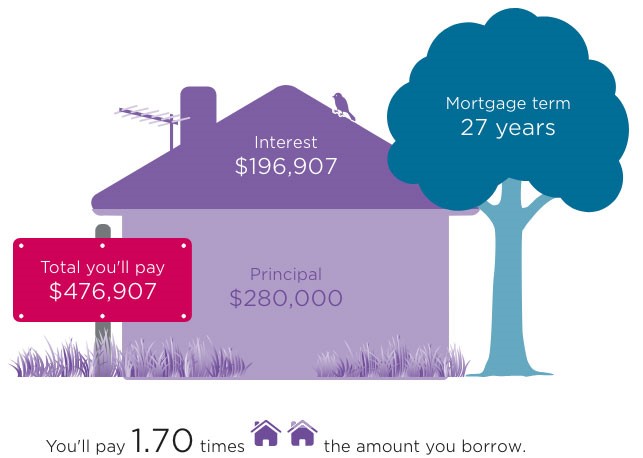

With your current payments your mortgage looks like this:

Pay JUST $25 a week more and it could look like this….

“You will pay $37,338 less”

“You will pay it off 4 years earlier”

All for an extra $25 per week.

Tim: “Humph”

And off he went.

I thought that went pretty well!

No doubt I’ll find out in a couple of weeks how it all panned out...

Never miss an opportunity to use a windfall WISELY would be my advice; if anyone cares to take it?

Happy Saving!

Ruth

Images sourced from Sorted. You can use this mortgage calculator to work out what your mortgage could look like: https://sorted.org.nz/tools/mortgage-calculator

The information contained in this article is of a general nature and should not be taken as advice. It reflects the opinions of the writer only and does not necessarily reflect the opinions of NZHL (New Zealand Home Loans).